Ptet 2021 online form Last date ptet BEd 2 year online form Last date ptet online form Last

Further information is now available about the PTET, including the logistics of filing and the administration of the tax.. the NY DTF's website application. Also, taxpayers should note that March 15, 2022, is the deadline to pay the tax for 2021, elect-in to the tax for 2022 and make the entity's first estimated tax payment for the 2022.

PTET 2021 Online Form Kese Bhare How To Fill PTET Online Form 2021 PTET Form 2021 Fill

The pass-through entity tax (PTET) under new Tax Law Article 24-A1 is an optional tax that partnerships or New York S corporations may annually elect to pay on certain income for tax years beginning on or after January 1, 2021.

Ptet 2021 online form ptet 2021 subject combination ptet teaching subject kaise

SUMMARY. • The law known as the Tax Cuts and Jobs Act, P.L. 115-97, imposed a $10,000 limitation on individuals' deduction of state and local taxes (SALT) for tax years 2018 through 2025. • In Notice 2020-75, the IRS announced forthcoming regulations under which partnerships and S corporations (passthrough entities, or PTEs) may deduct.

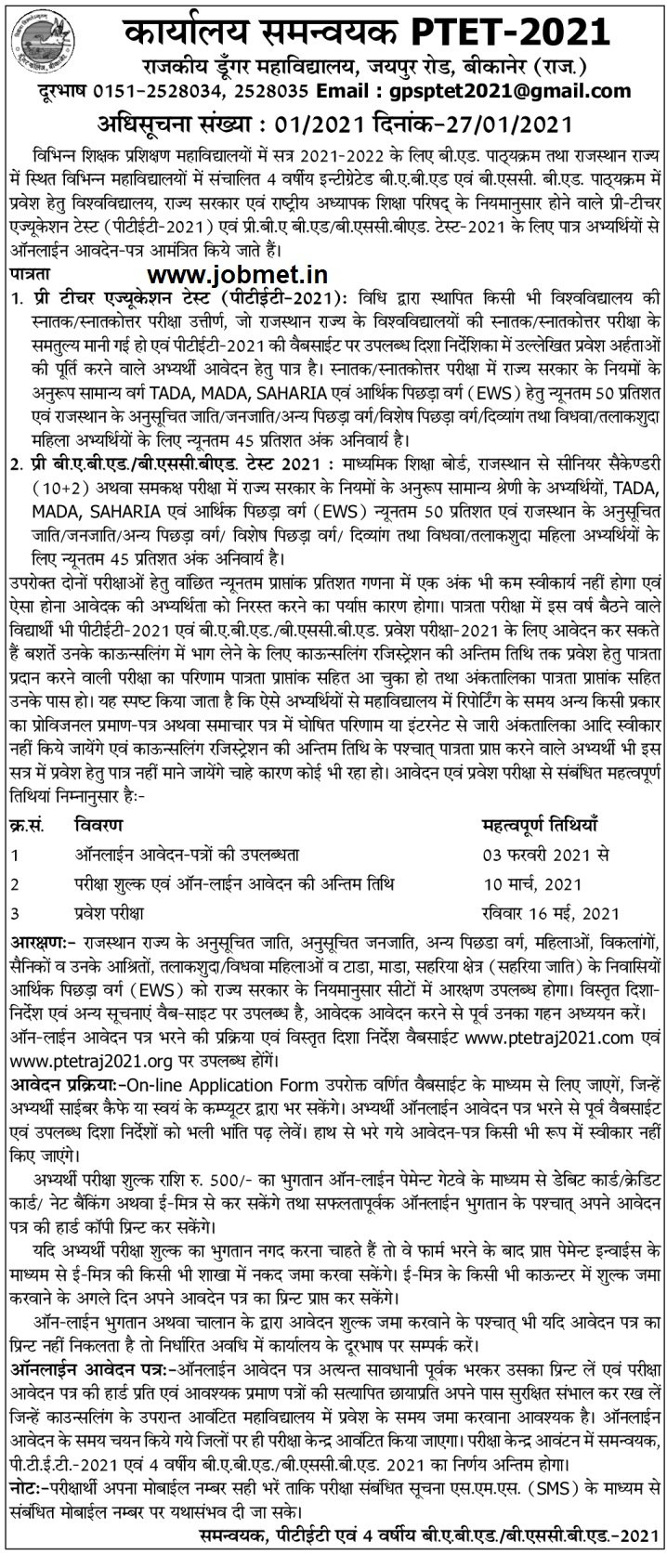

PTET 2021 Application Form Released; Here's Link and Registration Process AglaSem News

On September 30, 2021, the Massachusetts Legislature enacted an elective pass-through entity (PTE) excise in response to the $10,000 cap on the federal state and local tax (SALT) deduction added in the 2017 federal Tax Cuts and Jobs Act. Massachusetts joins several other states in enacting an entity-level excise that responds to the SALT cap.

PTET refund 2021 // ptet 2021 refund form // 5000/22000 fees refund ptet 2021 // refund form

Acts 2021-1 (p 43) amended by Acts 2021-423 Updated Temporary Guidance for Electing Pass-Through Entities None. 2021 Ala. H.B. 170, §10(b)(1) Refundable credit. IN SEA 2 PTET election form and guidance None. New IC 6-3-2.1-2(1) Refundable credit IC 6-3-3-3(d) as added by SEA 2 (2023) 3.23% SALT Parity Act SALT Parity Act - FAQs KY

Rajasthan Ptet 2021 form me correction kese kare/How to correction ptet 2021 form/Ptet 2021 news

The New York State Department of Taxation and Finance issued a Pass-Through Entity Tax (PTET) technical bulletin last August and provided updates via its website.While questions remain, deadlines loom for paying any balance owed for 2021 PTET (if applicable), for opting in for 2022, and for providing a first quarter 2022 payment.Now is a good time to review what we know so you can plan.

Rajasthan PTET 2021 Application Form, Eligibility, Exam Date

IR-2024-04, Jan. 8, 2024 — The Internal Revenue Service today announced Monday, Jan. 29, 2024, as the official start date of the nation's 2024 tax season when the agency will begin accepting and processing 2023 tax returns.

Ptet 2021 online form Last date ptet BEd 2 year online form Last date ptet online form Last

An online estimated tax application for PTET will be available by December 15, 2021. Personal income tax estimated payments for 2021 must still be made by or on behalf of partners, members, or shareholders under Article 22, calculated as if they were not entitled to the PTET credit.. Eligible taxpayers may claim the credit on Form IT-653.

PTET 2021 Online Form Fillup ptet 2021 ka form kaise bhare PTET online Form 2021 BEd, BA

Deloitte Tax LLP | June 7, 2021 Overview New York's 2021-2022 Budget Act (including S2509C/A3009C, among other bills) enacted on April 19, 2021, includes a new elective pass-through entity tax (PTET).

PTET 2021 ONLINE FORM IMPORTANT NEWS YouTube

What form to file For taxable years beginning on or after January 1, 2021, and before January 1, 2026, qualifying pass-through entities (PTEs) may annually elect to pay an entity level state tax on income. Qualified taxpayers receive a credit for their share of the entity level tax, reducing their California personal income tax. Do you qualify?

Ptet 2021 Form Starting on 3 Feb apply for Fees Refund ptet online lessions Starts YouTube

Pass-Through Entity (PTE) Tax. The Pass-Through Entity (PTE) Tax allows an entity to pay a tax on behalf of their partners, members, or shareholders. The PTE tax election is available for entity's tax years beginning after December 31, 2020, and before December 31, 2025. For Tax Year 2023 and After [+] For Tax Years 2021 and 2022 [+]

Rajasthan PTET 2021 Notification Application Form & Dates, Eligibility

Payments and forms Credit ordering Taxpayers with OSTC PTE election and qualifications Only qualified entities may make a PTE election to pay the entity-level elective tax. How does a qualified entity make the PTE election? Can a general partnership be a qualified entity?

Rajasthan PTET EXAM 2021 Application Form,Exam Dates,

PTET Payments and Returns For 2021 , an entity has the option to make a payment of estimated PTET . There will be an online application by December 15, 2021 to accomplish this. While the law calls for payment of the 2021 tax in March 2022, the option to make a payment in 2021allows cash-basis taxpayers to take the deduction in 2021.

PTET 2021 Form Reopen / PTET Form Reopen 2021 / PTET 2021 Exam Form YouTube

New York's webpage explains that an online estimated tax application for the PTET will be available by December 15, 2021. Annual Return: Per guidance, an electing entity must file an annual PTET return using the online return application to report the information required under Article 24-A for the PTET taxable year.

Rajasthan PTET Online Form 2021 (Out) Apply Online for Pre BED Exam

Governor Newsom signed California Assembly Bill 150 into law on July 16, 2021. This new law allows certain pass-through entities to annually elect to pay an elective tax in the amount of 9.3% of the pro rata share or distributive share of the entity's partners, shareholders, or members.

PTET 2021 application form Rajasthan Pre B.Ed GK in Hindi 2022 Samanya Gyan

However, there is an option to Quick File the 2022 PTET form without logging in. The 2022 PTET form on GovConnectIowa is a supplement to the pass-through entity's 2022 IA 1065 partnership return or 2022 IA 1120S S corporation return. The entity must file its 2022 IA 1065 or 2022 IA 1120S on or before the date it files its 2022 PTET form. In.